The sustainable techbank

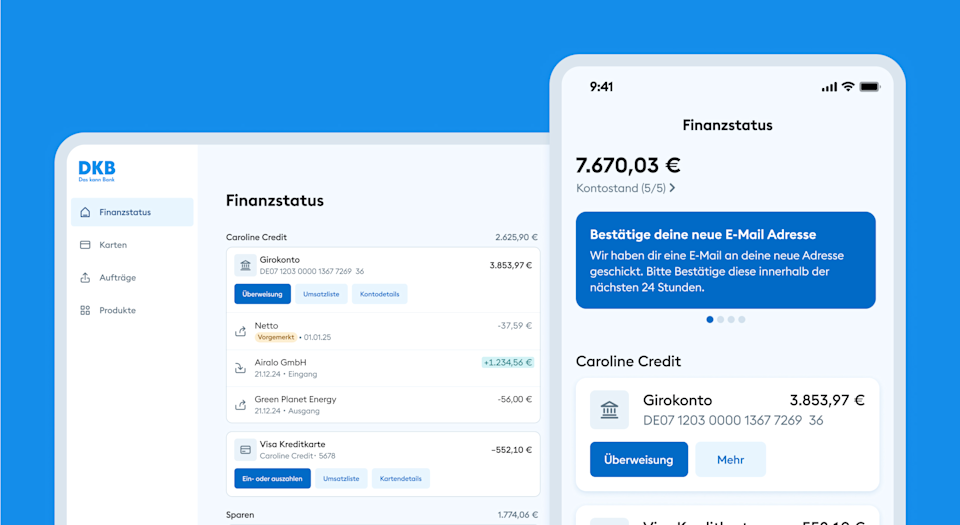

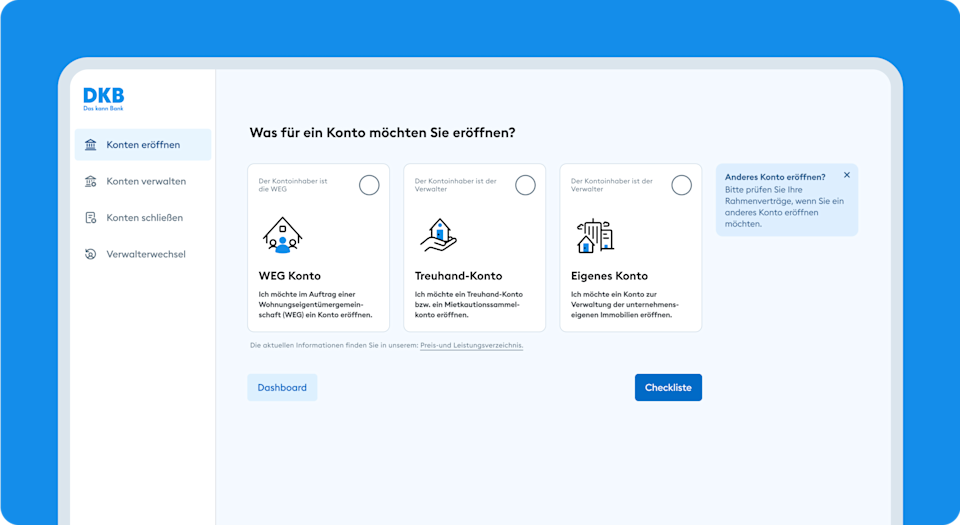

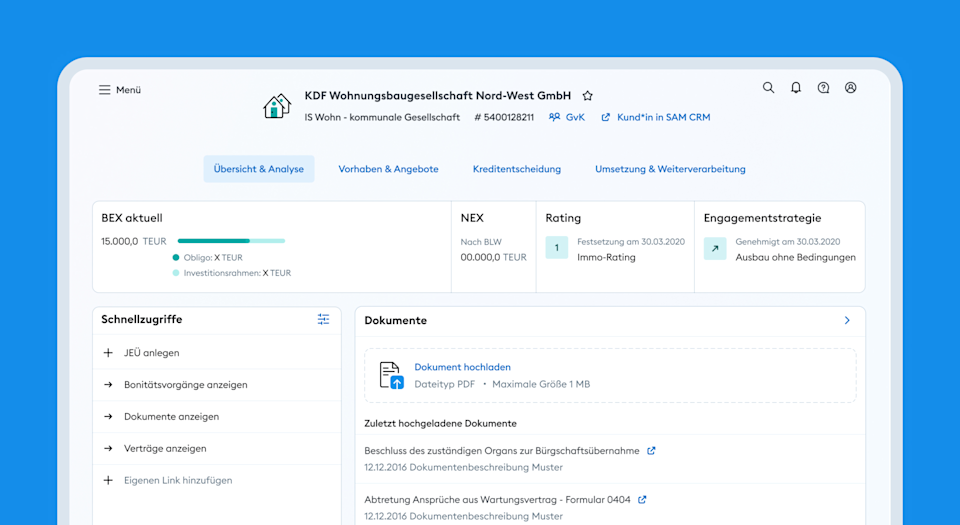

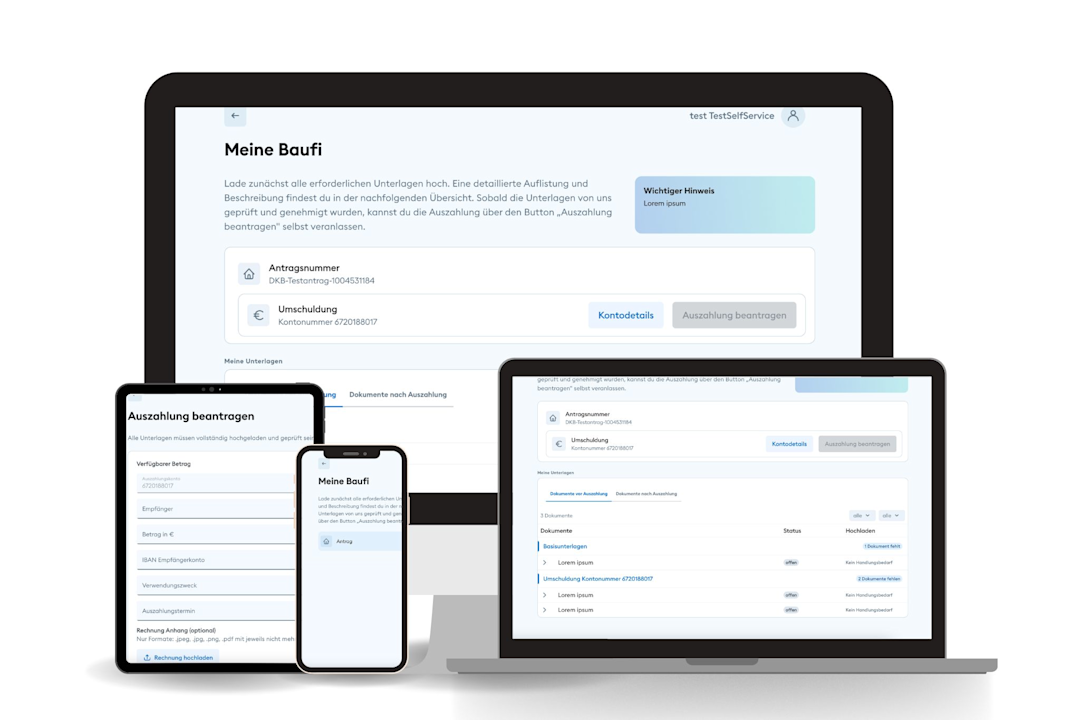

Our mothership, Deutsche Kreditbank (DKB), focuses on two main areas: Retail for private customers (accounts, credit cards, investments) and Business Customers (loans, financing).

Notably, at least 85% of our funds are reinvested in sustainable products, such as agriculture, renewable energy, and social infrastructure. DKB ranks among the top 3 German direct banks. To maintain this position, we at Code Factory support the development of user-centric, stable, and innovative digital products.